The Hidden Cost of Insurance Call Volume: Why Clean Claims Matter More Than You Think

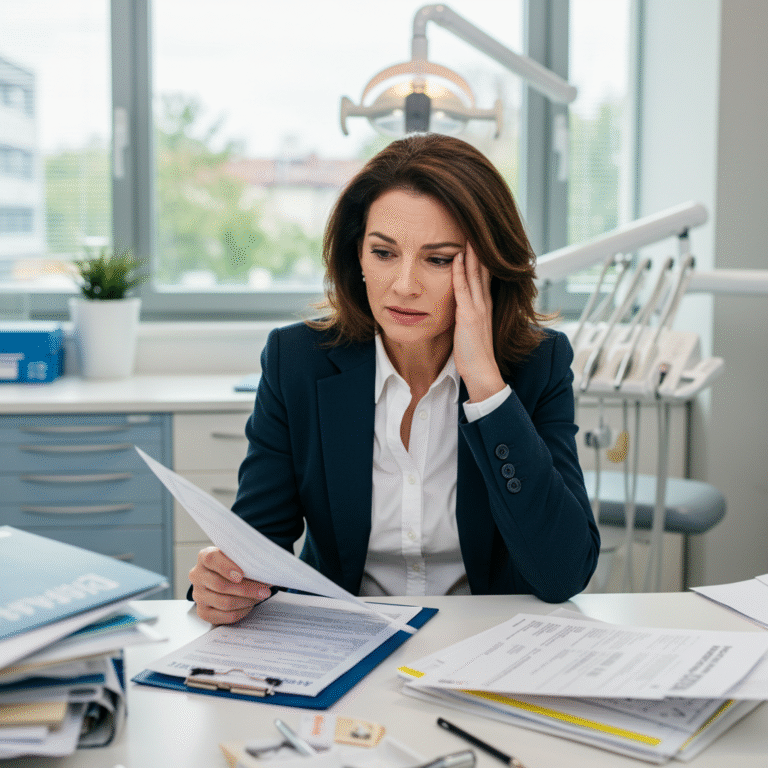

That familiar on-hold music starts up again the same tune you’ve heard countless times this week. While patients wait and your team juggles the day’s schedule, your top biller is still on the phone, stuck in a payer’s menu maze simply trying to get answers on a claim that’s lingered unresolved since last month. If you manage a dental office, you know this is hardly a rare occurrence. In fact, for many, it’s just part of the job. But it doesn’t have to be.

Every one of those calls signals a hidden expense. High insurance call volume quietly drains office productivity and staff morale. It drags out your revenue cycle and leaves everyone from providers to payers feeling frustrated. What’s more, the same pain you feel is echoed by payers, who want a smoother process as much as you do.

This article uncovers what’s really at stake with excessive insurance calls. You’ll get actionable advice on moving from firefighting and follow-up toward genuine efficiency driven by clean claims, data discipline, and streamlined automation. The result: quicker payments, reduced accounts receivable, and a more focused, less stressed team.

Why Are So Many Dental Offices Calling Insurance?

It often feels like the entire revenue cycle is a race for missing information. Here’s the usual pattern: You submit a claim, and then you wait. After weeks go by, maybe you get a denial or a request for clarification, or you notice the claim has been “pended” with no explanation. The ERA (Electronic Remittance Advice) spits out a vague reason code, but you’re still left guessing the next step.

So, the phone comes out.

Every phone call is a symptom of a larger system problem. Some detail in your original submission wasn’t precise enough for automated processing. Suddenly, your team ends up troubleshooting issues that could have been avoided, like:

- Forgetting to include a narrative for a crown procedure

- Entering treatment codes in the wrong order

- Using outdated eligibility data

- Missing an X-ray or other crucial attachment

This constant back-and-forth chews up valuable hours. While your staff sits on hold or tracks down answers, important work is postponed patient accounts can’t be managed, aging reports stack up, and your cash flow stalls as AR grows.

Counting the (Real) Cost of High Call Volume

It’s easy to spot the expense on your end: lost productivity, delayed income, and rising staff frustration. But the burden doesn’t stop with you. Payers feel the impact, too, and recognizing this connection is key to improvement.

Every single provider call brings a direct, tangible cost to the insurer. Think large call centers, extensive agent training, and maintenance for their tech infrastructure. Industry numbers peg a single live call anywhere from $6–$25, depending on complexity. Multiplied by thousands of offices all phoning about preventable issues, it’s a massive financial hit on their end.

To manage these costs, payers tend to:

- Understaffed support centers. Predictably, this leads to lengthier hold times.

- Adopt a tiered support system, so practices slog through endless menus or junior staff before reaching someone helpful.

- Make automated processing rules more restrictive. Trying to filter out errors at scale can lead to more denials for offices whose claims aren’t perfectly clean.

Bottom line: payers are highly motivated to see fewer calls. Their best opportunity for this is to reward offices that submit claims with complete, precise, and properly formatted information no extra steps needed from their teams.

Tracing the Root Cause: Dirty Data and Workflow Gaps

Those never-ending phone calls are a symptom; the disease runs deeper. Most claim headaches are rooted in “dirty” data meaning errors, missing pieces, or incorrect formatting that slow or block automated adjudication. We’re not talking about fraud or complicated billing tricks here, just routine mistakes that stall payments.

Some of the most common root causes include:

- Eligibility lapses and missed verifications: Submitting claims for patients with inactive or incorrect coverage.

- Incorrect coding: Billing codes not matching up with a plan’s coverage, or errors in how the treatment was documented.

- Omitted paperwork: Required narratives, films, or perio documentation not attached.

- Typos in provider or patient details: A single letter or digit can lead to denials or EDI rejections.

- EDI (Electronic Data Interchange) hiccups: A glitch in the file format causes the claim to bounce before it even reaches the payer’s system.

Payers crave clean claims their lowest-cost, most efficient means of closing out a claim file. Clearing your own internal messes not only improves your bottom line; it directly helps the insurer, aligning your practice goals with theirs for mutual benefit.

Clean Claims: Why They Matter For Everyone

So, what constitutes a clean claim? It’s a submission that ticks off every requirement for a specific payer: complete, accurate, properly formatted, and furnished with the required support documents right from the start.

When you achieve this level of accuracy, the payoffs stack up quickly:

- Fewer denials: Most denials stem from administrative slip-ups, not medical disputes. Clean claims greatly reduce these occurrences.

- Drastic drop in phone calls: Minimize pended claims and you instantly reclaim hours for your billing team.

- Quicker payments: Approvals happen faster, accelerating your revenue stream and slashing AR days.

- Better use of staff: With less time spent chasing the payer, your team can shift energy into revenue-driving projects and patient care.

Getting there isn’t about pushing your staff harder. It’s about giving them smarter tools and real process clarity.

Solutions: Building Discipline, Smoother Workflows, and Smart Automation

Shifting from survival mode to a truly efficient revenue cycle boils down to three main efforts: data discipline, strong workflows, and harnessing automation that catches errors before claims ever leave your office.

1. Prioritize Front-End Data Accuracy

A clean claim starts at intake before the patient ever sits in the chair. Train your admin staff to be meticulous about collecting and verifying demographics, coverage info, and subscriber details. Build in checklists and protocols to cut out data slip-ups before they can disrupt the billing process.

2. Insist on Real-Time Eligibility Confirmation

Don’t trust insurance information from last month policy changes happen fast. Always verify eligibility and coverage on the day of the visit. Use automated checks in your PMS or trusted third-party services to eliminate surprises and catch denials from the start.

3. Close the Loop Across Teams

Getting information from the operatory to the billing desk without anything falling through the cracks isn’t easy if your teams work in silos. Build cross-team workflows and checklists make sure clinical staff document and pass along every detail required for a claim. Foster tight team communication so nothing gets lost.

4. Harness Advanced, AI Claim Scrubbing

No matter how dedicated your billing crew is, people can overlook details especially when payer rules constantly change. AI-powered scrubbing software steps in by reviewing claims against huge libraries of payer rules, flagging likely denials or missing components before those claims ever leave your system. This tech gives your team a final chance to fix errors and avoid rejections.

How EDiFi From Elite Dental Force Makes the Difference

This is where EDiFi steps in. Built specifically for dental RCM, EDiFi isn’t just a generic claim checker it’s an AI-driven platform designed to operationalize clean claim workflows at scale.

Seamlessly integrating with your existing office software, EDiFi works hand-in-hand with your billing team to:

- Validate data before submission: EDiFi pre-checks every claim against a comprehensive set of payer-specific rules, confirming details are complete, accurate, and compliant.

- Proactively flag likely denials: The system highlights claims at high risk for denial, including those missing critical docs or with code conflicts, and delivers clear, actionable guidance.

- Automate your workflow: Rather than flooding your team with all claims, EDiFi routes only the truly exceptional cases those requiring human judgment—to your staff, eliminating most preventable errors and the related phone follow-up.

What’s in it for you? Tangible results: far fewer follow-up calls, lower AR balances, faster payments, and a huge reduction in burnout for your team. Payers also benefit from receiving cleaner claims, improving working relationships and processing speed.

Stop Chasing Start Systemizing

Blaming denials or backlog on so-called “bad billers” or “lazy insurance agents” misses the real issue. Revenue cycle problems in dentistry almost always come down to broken systems, not flawed people. Chances are, your staff is committed and doing their best within chaotic, manual workflows.

No one can memorize every single payer rule. Practices that move from superhero mentality to system empowerment see the strongest, most sustainable improvements in AR and team morale.

When claims are truly clean, the need for follow-up calls disappears. Putting data accuracy, smart automation, and EDiFi to work for your office means the revenue cycle runs silently in the background giving your staff time to focus on patient care and practice growth.

Ready to significantly reduce phone time and AR drag?

- Connect with our team on LinkedIn to continue the discussion.

- Follow Elite Dental Force for deeper RCM insights.

- Schedule a quick EDiFi walkthrough to see firsthand how AI-powered clean claims can transform your practice.